MEDIA CONTACT

Daniela Valencia

PRESS RELEASE

Talonvest Capital Negotiates $53 Million Construction Loan

January 25, 2024 — Irvine, CA

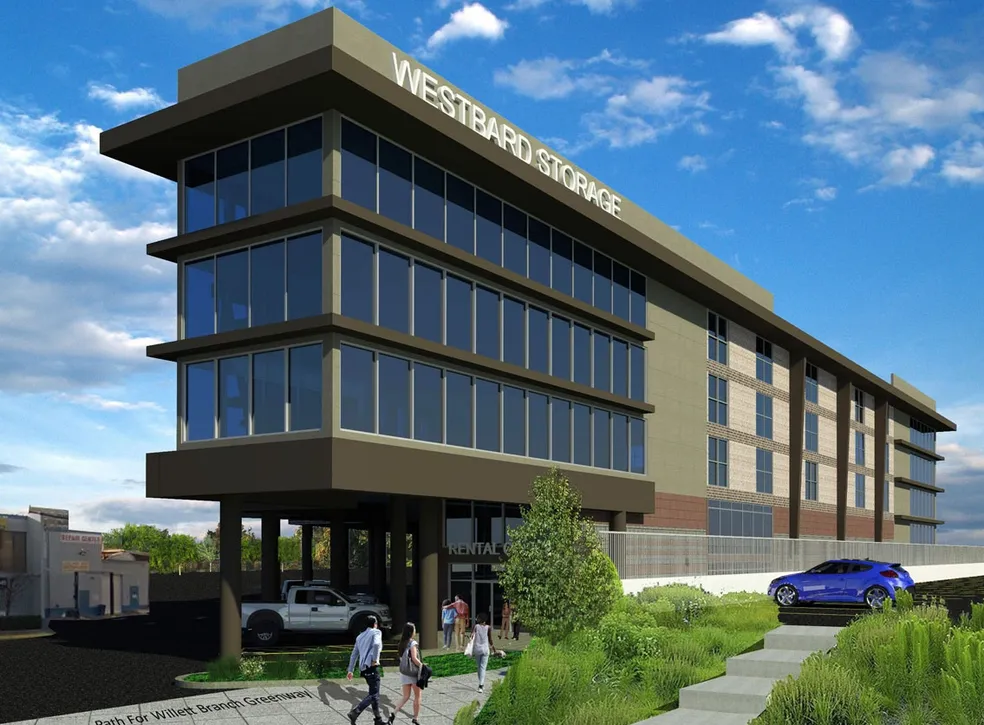

Talonvest Capital, Inc., a boutique self storage and commercial real estate advisory firm, and its longtime client, 1784 Holdings, are pleased to announce the closing of a $53,000,000 construction loan for the development of a Class-A self storage facility in Bethesda, MD. The site benefits from high visibility and easy access in an affluent community adjacent to Washington, D.C., with only 3 competitive storage facilities within a 2-mile radius.

The construction loan included a 28-month term with two extension options, full-term interest-only payments, an earnout funding upon receipt of the full certificate of occupancy, and no lease-up covenants. Talonvest successfully negotiated a springing rate cap, allowing the borrower to forgo the costs of a purchase at closing. The financing was funded by a privately held real estate firm.

Shane Albers, Chairman and CEO of 1784 Holdings, commented, “We have a longstanding relationship with Talonvest, and their commitment to consistently deliver results across numerous deals is a cornerstone of our collaborative success. They serve as expert advisors, and we deeply value the team’s insights and vast network of capital providers.”

The Talonvest team representing 1784 Holdings on this assignment included Kim Bishop, Jim Davies, Ivan Viramontes, Tom Sherlock, and Lauren Maehler.

About Talonvest Capital, Inc.

Talonvest Capital is a boutique real estate firm providing advisory services to self-storage and commercial real estate investors, owners, and developers throughout the United States. The firm utilizes a collaborative team approach, emphasizing the team member’s institutional knowledge and expertise gained over the past four decades to structure superior capital solutions for its clients.

Stay Informed

Subscribe to stay up to date on current trends in the perm, bridge, and construction lending market based on our real deal experiences and discussions with banks, life companies, debt funds, private lenders, and CMBS lenders.